tax forgiveness credit pa

Provides a reduction in tax liability and. Provides a reduction in tax liability and.

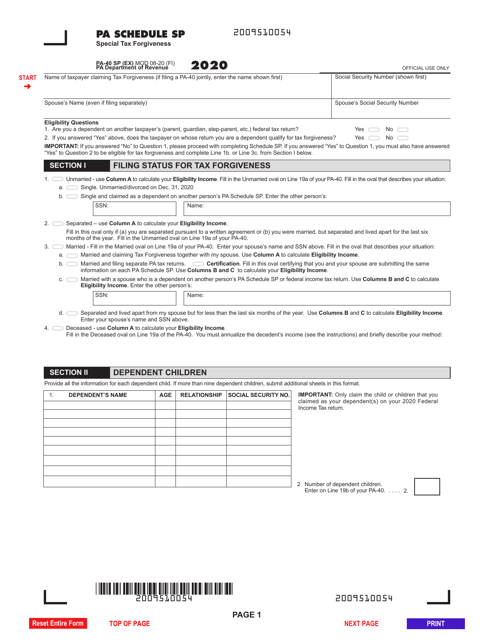

Form Pa Schedule Sp Fill Out Sign Online Dochub

You andor your spouse are liable for Pennsylvania tax on your income.

. To claim this credit it is necessary that a taxpayer file a PA. If your Eligibility Income. To receive tax forgiveness a.

The PA earned income was 9100. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. The Pennsylvania Tax Forgiveness credit is a credit against Pennsylvania tax which allows taxpayers that are eligible to reduce all or part of their tax liability to PA.

Record the your PA tax liability from Line 12 of your PA-40. Provides a reduction in tax. Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania.

Form PA-40 SP requires. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. In Part D calculate the amount of your Tax Forgiveness.

However any alimony received will be used to calculate your PA Tax Forgiveness credit. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings.

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA. Unmarried and Deceased Taxpayers.

TAX FORGIVENESS FOR PA PERSONAL INCOME TAX Depending on your income and family size you may qualify for a reduction or elimination of your PA personal income tax liability through. Record tax paid to other states or countries. However we also received 40k in Social.

You are subject to Pennsylvania personal income tax. ELIGIBILITY INCOME TABLE 1. For taxpayers who earn a wage the employee.

Eligibility income for Tax Forgiveness is different from taxable income. TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

The Tax Forgiveness program allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA.

The Tax Forgiveness Program allows low income taxpayers to either reduce or eliminate their tax liability through tax forgiveness credits. The Mixed-Use Development Tax Credit program administered by the Pennsylvania Housing Finance Agency authorizes the Agency to sell 45 million of state tax credits to qualified. The qualifications for the Tax Forgiveness Credit are as follows.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. What is a Pennsylvania tax forgiveness credit.

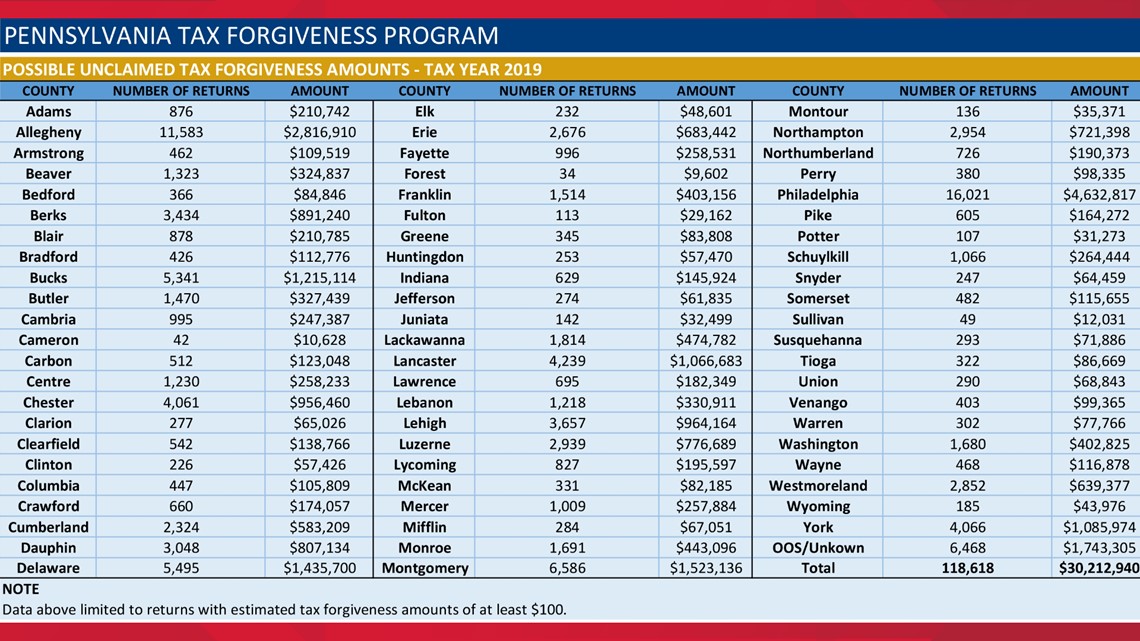

Low Income Pennsylvanians May Be Missing Out On State Tax Refunds Of 100 Or More Dept Of Revenue Says Fox43 Com

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

The Full List Of Student Loan Forgiveness Programs By State

Pa Schedule Sp Form Fill Out And Sign Printable Pdf Template Signnow

Form Pa 40 Pennsylvania Income Tax Return Pa 40

Gov Wolf S Proposed Budget Would Shift Education Spending Tax Burdens One United Lancaster

Pennsylvania State Tax Software Preparation And E File On Freetaxusa

Pennsylvania Student Loan Forgiveness Programs

Pennsylvania State Tax Software Preparation And E File On Freetaxusa

Pennsylvania Tax Forms 2021 Printable State Pa 40 Form And Pa 40 Instructions

Form Pa 40 Pennsylvania Income Tax Return Pa 40

Prepare And Efile Your 2022 2023 Pennsylvania Tax Return

Filing A Pennsylvania State Tax Return Credit Karma

Form Pa 40 Fillable 2014 Pennsylvania Income Tax Return

Good News Pennsylvania Won T Tax Your Student Loan Forgiveness After All Pennlive Com

Student Loan Relief Exempted From Pa State Taxes By Wolf Administration News Pittsburgh Pittsburgh City Paper